Rent Save Apps from the County 2025 Modify: Ideas on how to Implement

Blogs

When they discover they can lease the newest flat easily, they may enable you to out of the rent. Or, they could ensure it is various other renter when deciding to take along side rest of your own rent. Long lasting situation, talk to your landlord about any of it before they bring court action.

Simple mate rescue

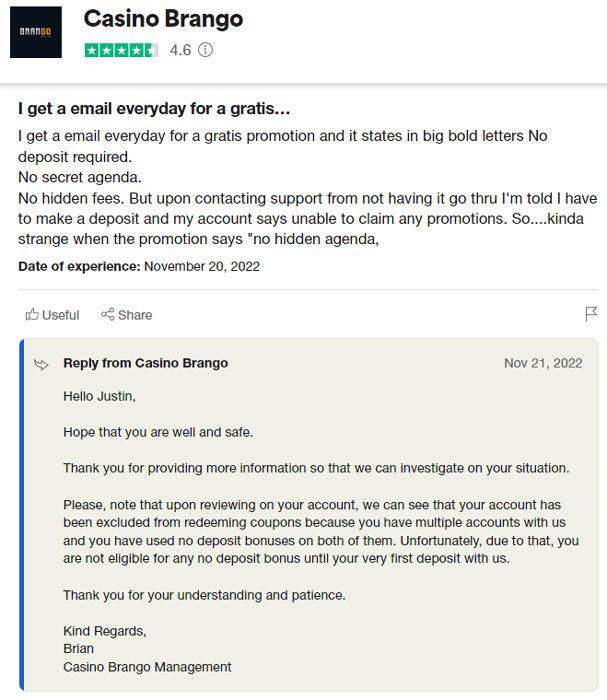

Failure to pay conversion process or have fun with tax can result in the brand new imposition from punishment and you can desire. The fresh Income tax Agency conducts routine audits based on guidance casino reviews cashback bonuses gotten from businesses, such as the U.S. When you’re claiming people nonrefundable credits, complete the suitable credit variations and you may Setting It-203-ATT, Almost every other Income tax Credit and you will Taxes. While you are owed a refund, we’re going to deliver the new reimburse and an enthusiastic explanatory report. For many who owe tax, you will discover an expenses that must definitely be paid within this 21 months, or from the April 15, 2025, almost any is later on. Dividends you acquired of a regulated money company (mutual fund) you to invests inside financial obligation of one’s You.S. regulators and you will meet up with the 50% asset requirements per quarter qualify for which subtraction.

Up to $step one,600 to your First 4 Dumps

To find out more, along with significance of one’s words «repaired foot» and you may «long lasting organization,» see Bar. To decide taxation to your nontreaty money, shape the newest tax during the both the newest apartment 29% rates or perhaps the finished price, depending on perhaps the money try effectively linked to the change or company in america. An excellent nonresident alien is always to fool around with Mode 1040-Es (NR) to work and you may spend projected tax. For those who shell out from the consider, ensure it is payable to «United states Treasury.» To own a list of newest international societal defense preparations, go to SSA.gov/international/status.html.

- While the a member, you can vote agreeable elections, and any payouts the financing connection becomes is actually passed thanks to finest cost on the financing and you can bank accounts.

- If you discover alterations in your revenue, write-offs, otherwise credit when you post your get back, file Form 1040-X.

- Personal shelter coverage will bring pensions, survivors and you will disability professionals, and medical insurance (Medicare) benefits to those who see particular qualifications criteria.

- Shop You.S. stores on the internet and appreciate shorter price distribution where you can find Canada.

- In case your decedent will have end up being 59½ throughout the 2024, enter only the matter acquired following decedent could have be 59½, however more than $20,one hundred thousand.

In the event the partnered/or a keen RDP and you may submitting separate tax returns, you and your spouse/RDP have to both one another itemize your deductions (even when the itemized write-offs of 1 partner/RDP is less than the standard deduction) or both make simple deduction. Head Deposit Reimburse – You can request a direct put reimburse in your tax return whether or not your e-document or document a newsprint taxation get back. Be sure to submit the fresh routing and you will account number carefully and you will double-see the quantity to own precision to stop they getting denied by the financial.

Arthur obtained gross income of $25,900 in the tax 12 months of offer inside the All of us, consisting of the next items. Nonresident aliens who’re needed to file a taxation return is always to have fun with Setting 1040-NR. The fresh You.S. taxation come back you should file since the a twin-reputation alien relies on regardless if you are a resident alien or a good nonresident alien at the end of the fresh tax 12 months. Income away from source away from United states that’s not efficiently regarding a swap otherwise company in the united states is perhaps not taxable if you discover they while you are an excellent nonresident alien. The amount of money isn’t nonexempt even although you made they if you are you were a resident alien or you turned into a citizen alien or a U.S. resident immediately after getting it and you can before the prevent of the season.

Whilst the college student is becoming a resident alien, the brand new terms away from Article 20 however apply from the exemption for the protecting condition within the part dos of the Protocol to help you the newest You.S.–Mans Republic out of Asia pact old April 30, 1984. The brand new college student is always to report their grant income found on the Mode 1042-S otherwise Mode 1098-T for the Schedule step one (Setting 1040), line 8r. They is always to report the quantity where pact advantages is actually said, in the parentheses, on the Plan step 1 (Function 1040), line 8z. They have to get into «Exempt earnings,» title of one’s treaty nation, and the pact blog post giving the brand new exemption. One federal tax withheld from your own earnings inside income tax 12 months whilst you have been a good nonresident alien is actually acceptance because the a great fee against your own You.S. income tax accountability for the very same seasons.

Income-promoting assets includes savings profile, businesses, ties, and you may a property. Partners always equally separate earnings out of as one had assets. The funds and you will losses from a good taxpayer and mate need to be determined individually. You might not away from-put the funds of your taxpayer that have a loss of profits on the mate and you will the other way around. Accommodations protection put is currency repaid because of the occupant to the newest property owner while the a promise your renter will abide by the fresh small print of your own lease.

We’re also maybe not an attorney, so we can be’t give one advice otherwise viewpoints in the you’ll be able to legal rights, cures, defenses, possibilities, group of versions otherwise actions. And by loitering right here with Roost, you invest in all of our Terms of service, Courtroom Disclaimer, and you will Advertising Revelation. Connecticut is another state in which renter liberties activists have swayed the new laws and regulations away from security deposits. Per state has its own book approach to controlling shelter deposit interest laws. For example, Ny mandates a good prevalent speed to have houses with six or more devices, while Ca features local ordinances inside the cities such as Bay area. Should your occupant motions aside prior to the prevent of your own 12 months, up coming focus is actually repaid to the avoid of their tenancy otherwise put in the shelter deposit refund.

Choose only the segments you desire, and you will configure them because of the property or profile. NED discounts is for all of us beneath the age 62 having a handicap to simply help see and pay money for leasing housing. Whether your’lso are a skilled resident or simply just doing, understanding exactly what a rental move are and how to perform one is paramount to optimizing their leasing prope… A landlord must prove your occupant brought about possessions damage you to exceeds typical deterioration. Simultaneously, the fresh property manager should provide evidence of the cost sustained (otherwise projected in order to sustain) to fix the damage.

Nonresident aliens aren’t subject to notice-a career tax except if a major international societal shelter contract in place find that they’re protected under the U.S. personal security measures. Virgin Isles, Puerto Rico, Guam, the new CNMI, or American Samoa are thought U.S. residents for this function and they are at the mercy of the brand new notice-employment taxation. You can find more info from the global social shelter plans, after. If the More Medicare Taxation is withheld from your own spend by mistake, you can claim a cards for the withheld Extra Medicare Income tax up against the full tax accountability revealed in your tax come back because of the processing Mode 8959 which have Mode 1040, 1040-SR, or 1040-NR. You could be considered when deciding to take an income tax credit as high as $16,810 to own being qualified costs paid back to consider an eligible kid. Which number could be invited on the adoption away from a child which have special requires regardless of whether you may have being qualified expenses.

Protection Deposits & Related Court Standards to possess Landlords

For more information, come across certain line tips to have Mode 540, range 91. All other earnings that you receive away from Ny Condition provide when you are a great nonresident may be at the mercy of tax. When you yourself have a civil jobs within the New york Condition while in the the of‑obligations instances, the funds you can get is actually susceptible to taxation.