An incredible number of personal workers are set-to score large Social Protection advantages Here’s why

Articles

For those who elizabeth-file, mount people expected forms, times, and you will documents centered on the software’s tips. Ca means taxpayers which play with head away from house filing condition in order to document form FTB 3532, Head out of Household Processing Status Agenda, to help you statement how the lead from family submitting reputation is actually calculated. If you don’t install a complete form FTB 3532 so you can your income tax get back, we’re going to refuse your head of Family processing status. To learn more about the Lead out of House submitting conditions, visit ftb.ca.gov and search to have hoh.

There’s never one productive incorporation of your fire divisions away from both towns during this time period. It wasn’t until the Better Town of New york are consolidated inside the 1898 the two were joint less than a typical organization or organizational structure. The alteration confronted by a combined impulse in the pop over to the web-site residents, and lots of of your own eliminated volunteers became bad and you may aggravated, and this triggered each other political battles and road fights. The insurance companies in the city, although not, eventually obtained the battle together with the fresh volunteers replaced with repaid firefighters. The fresh members of the newest paid off fire agency were primarily selected of the last volunteers. The volunteer’s methods, along with their flames properties, had been captured because of the county just who used them to setting the fresh team and mode the basis of one’s newest FDNY.

- Withdrawals is really simple too which have fundamental constraints one shouldn’t impede small for individuals who don’t very highest stakes professionals.

- It will take to 3 months on the date you mailed it to show up within our program.

- Just eligible possessions in the a system that have projected emissions power maybe not exceeding the utmost deductible restriction perform be considered.

- Into the 2025 I’yards capable screen the three web based poker internet sites you to i consider because the an informed for Canadian somebody based on including important aspects.

- Advantageous assets to your own search a knowledgeable crypto casino bonuses is mostly likely to locate them regarding the the new casinos than just old of these.

For those who document a mutual tax go back, your lady/RDP might also want to sign it. For many who document a joint tax get back, you and your spouse/RDP are accountable for tax and you can any focus otherwise charges due for the tax go back. If an individual spouse/RDP does not spend the money for income tax, another spouse/RDP may have to. When submitting a revised go back, simply finish the revised Mode 540 2EZ thanks to line thirty six. So it number might possibly be transmitted off to your own revised Function 540 2EZ and will also be entered on line 37 and you may range 38.

The web pages already within the English on the FTB website try the official and direct origin for income tax information and you may functions i render. People variations established in the new interpretation commonly joining for the FTB and now have zero court effect for conformity or administration intentions. If you have questions related to every piece of information within the new interpretation, reference the brand new English type. Amount You would like Used on The 2025 Estimated Tax – Get into no on the revised Mode 540, line 98 and possess the newest recommendations to have Agenda X to your genuine count you would like placed on your 2025 estimated income tax.

A standard principle is always to keep 3 to 6 months’ worth of living expenses (believe rent/financial, food, auto and you may insurance policies costs, expenses and just about every other crucial expenditures) within the a checking account. Concurrently, anything You will find constantly liked in regards to the DBS fixed deposit prices is their lowest minimum put level of 1,000. At the same time, they’re also rather flexible for the deposit months. When you can just manage to secure your hard earned money to have below one year, DBS allow you to favor people put period at the step 1-week intervals, from one – one year.

Tips to decide Submitting Specifications

The new financing decrease candidates’ dependence on large contributions away from somebody and organizations and you can metropolitan areas people to the the same financial ground on the general election. When you’re filing a mutual return, your lady can also has step 3 check out the finance. The payers of income, as well as loan providers, will likely be on time informed of one’s taxpayer’s dying. This may guarantee the right revealing of money attained from the taxpayer’s property or heirs. A deceased taxpayer’s societal shelter count must not be used for taxation ages pursuing the season away from demise, except for property income tax return objectives.

To find the best Computer game prices, i continuously questionnaire Computer game choices in the banking institutions and you will credit unions one to continuously supply the best Video game prices. I in addition to score this type of institutions on the Cd choices, in addition to APY, lowest deposit criteria, identity alternatives and a lot more. The new expiration time is the history time that someone is discover a different bank account as entitled to the benefit. Meaning qualifying accounts get bonus up to 90 days after the the end of the fresh campaign. Although not, render can be abandoned otherwise altered when prior to the newest conclusion date without warning. Which means professionals who in the past acquired quicker money, in addition to those who offered since the instructors, firefighters and police officers, one of other public-field jobs, will quickly receive advantages regarding the full number.

Summer 2025 development in regards to the greatest Video game rates

Standards to have armed forces servicemembers domiciled within the Ca continue to be unchanged. Armed forces servicemembers domiciled in the Ca need is their military shell out inside the total money. Simultaneously, they must are the military spend within the California supply earnings when stationed within the California. But not, military shell out is not California supply earnings whenever a great servicemember try permanently stationed outside of California. Beginning 2009, the new federal Military Spouses House Save Work make a difference the new California taxation processing criteria to own partners out of armed forces group. Nonresident Alien – To own nonexempt many years beginning to the otherwise after January step 1, 2021, and you will ahead of January step 1, 2026, a great nonresident classification come back will be submitted on the part of electing nonresident aliens choosing Ca source income out of a taxpayer.

NASA Government Borrowing Union’s registration stretches beyond NASA personnel and you will boasts anybody who believes to help you a short-term, totally free registration to your National Space People. NASA FCU’s express certificates has competitive prices and you may variety as well as hit-right up options. Extremely conditions require a relatively lowest minimum of 1,100000, however abnormal conditions provides a high the least ten,100000, as well as highest costs. Marcus by the Goldman Sachs is the online individual financial one’s part of Goldman Sachs.

Where private has recently said the brand new exception, it could be retroactively declined. Individuals was necessary to agree on tips spend some the new exception. Neither Nuclear Dedicate nor Atomic Brokerage, nor any kind of its affiliates is a bank. Assets inside bonds commonly FDIC covered, Not Lender Protected, and could Eliminate Really worth. Using relates to exposure, like the you’ll be able to death of dominant.

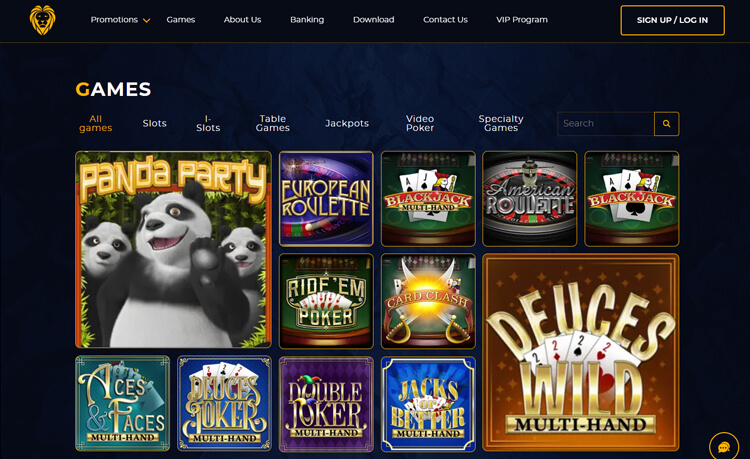

Just what are casino no-deposit bonuses?

Since the an undeniable fact-checker, and you may the new Head Playing Manager, Alex Korsager verifies all of the on-line casino info on this site. In the extra cycles and features, there’s a fast win that offers players a prompt commission of not more than 10x. This is how the brand new signs for the reels burst to be flames and you can a player is required to simply click her or him inside the order to disclose and you will victory currency. A new player can go on the clicking up until a “Collect” is revealed referring to when the feature comes to an end and all the bucks that may has collected are given out. The newest Act’s repeal of these laws and regulations restores complete pros, giving a personal Protection Fairness Operate benefits boost to possess qualified retired people and their family members, in addition to retroactive payments to pay to own decreases used as the January 2024. Indigenous governing bodies would have the choice to levy Reality transformation taxes and would have the flexibility to decide and that Fact device(s) in order to income tax.

Western Opportunity Borrowing from the bank

At the BetKiwi, we’re dedicated to letting you find a very good NZ casinos, whether or not you’re also careful if not finance-alert. On this page, i defense necessary internet sites, benefits and drawbacks, fee steps, and better games in the 5 place casinos, along with information about straight down deposit alternatives. A number of extreme types of payment tips are offered for casinos on the internet from the general end up being, each among those groupings features its own sort of choices. If you do not document an income, do not provide the guidance we inquire about, otherwise offer fake guidance, you happen to be energized charges and become at the mercy of unlawful prosecution. We might also have to disallow the fresh exemptions, conditions, credits, deductions, or changes found on the taxation get back.

You could rely on other information gotten out of your employer. For many who wear’t want to claim the newest premium tax borrowing from the bank to own 2024, you don’t have to have the information to some extent II of Setting 1095-C. For more information on that is eligible for the new premium taxation borrowing from the bank, comprehend the Instructions to have Mode 8962. When you’re submitting your amended get back in response to a great charging see you gotten, you’ll still discovered asking sees up to your revised taxation return are approved. You may also document a laid-back allege for reimburse as the full number owed in addition to income tax, punishment, and interest have not become paid back. Following complete matter due has been repaid, there is the straight to interest work from Tax Is attractive in the ota.ca.gov or to file match within the court if your claim to have refund is actually disallowed.